Bank of Punjab BOP is inviting applications for it upcoming recruitment process of various jobs.An exciting opportunity emerged in the Bank of Punjab and was proclaimed by the government of Punjab.

Punjab Bank BOP Jobs 2022

Posted on: 26th May 2022

Location: Pakistan

Education: Bachelor, Master

Last Date: June 06, 2022

Jobs: Multiple

Department: Bank of Punjab (BOP)

Job Address: The Bank of Punjab, Head Office, Lahore

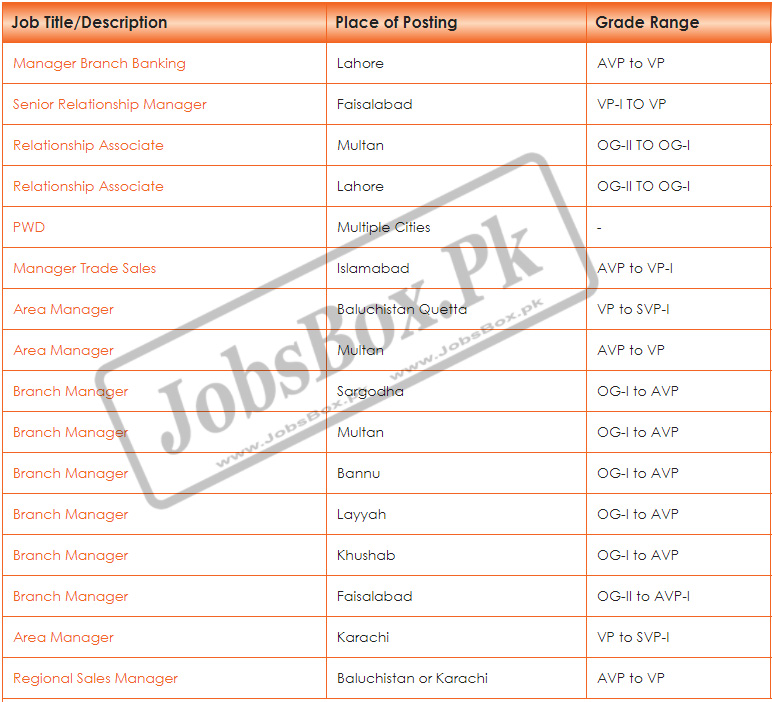

Vacant Positions:

- Area Manager

- Branch Manager

- Manager Branch Banking

- Manager Trade Sales

- PWD

- Regional Sales Manager

- Relationship Associate

- Senior Relationship Manager

Eligibility Criteria:

- For applying to the merit list, education and experience are important. A minimum Bachelor’s Degree/ Master’s Degree is required to apply for the post and higher degrees are also welcome.

How to Apply Online:

- Applicants interested in applying for the posts should go to the eligibility criteria section below.

- Applications are invited from across the country. Apply by 15th of the month.

- Candidates are advised to visit the official website of the bank and apply through the job portal www.bop.com.

Punjab Bank BOP Jobs 2022

How to Apply for a Punjab Bank BOP Job in 2022

Do you want to work at Punjab Bank in 2022? Are you interested in becoming a Branch Officer? If so, then read on to learn how to apply for Punjab Bank BOP jobs in 2022! We’ll help you navigate the application process from start to finish, including how to prepare your resume and what materials to include in your cover letter. We’ll also review some of the most frequently asked questions about the application process at Punjab Bank and much more!

Understanding Punjab Bank’s Business

Before applying for a job at any bank, it’s important to know exactly what their business does. You might already know that Punjab is India’s leading public sector bank by assets. But how did they get there? After over four decades of phenomenal growth, along with several mergers and acquisitions, they are now an integrated financial services provider with several diverse lines of business across asset management, corporate finance and investment banking, retail and commercial banking.

Brief History of Punjab National Bank

The PNB Group has been one of India’s most important and trusted banking institutions. In 2013, it was ranked as one of The World’s 50 Safest Banks by Global Finance. PNB has played an integral role in fostering India’s economic growth, particularly through its support of SMEs and financing for public projects. The bank also works closely with international financial institutions such as International Finance Corporation (IFC), Multilateral Investment Guarantee Agency (MIGA) and Asian Development Bank (ADB). PNB stands as one of India’s largest private sector banks, boasting more than 500 branches nationwide with over 17000 employees.

About Punjab National Bank

One of India’s most influential financial institutions, Punjab National Bank (PNB) was founded by Lala Dayal on February 6, 1894. It is headquartered in Mumbai and is one of largest commercial banks operating in India. PNB owns a sprawling network of 1,400 branches across India with over 13000 ATMs including 268 foreign exchange counters and 76 rural branches. The bank has more than 330000 employees serving some 37 million customers throughout India, which includes more than 1000 overseas offices spread across 39 countries.

Why Join Punjab National Bank?

If you’re looking to enter banking, with its attractive pay, job security and benefits that rival those of established industries, joining Punjab National Bank is one of your best options. Founded as early as 1894, it’s India’s second-largest state-owned lender. In addition to employment opportunities at its head office in Mumbai, PNB operates through hundreds of branches across India. The bank offers a wide range of services including checking accounts, savings accounts and loans on favorable terms. Its workforce includes employees from diverse backgrounds—be they blue-collar workers or highly qualified IT professionals—and applicants must take an aptitude test before being considered for hire. If you want join PNB but don’t know how to apply: Keep reading!

General Banking Awareness

In order to successfully apply for any job at any bank, it’s essential that you possess some basic understanding of how banks work. Research general banking terms and define them: liability, liquid asset, credit deposit ratio, securities deposit scheme, branch expansion policy etc. Keep a running list of terms you don’t know on your phone or computer so that you can reference it during an interview. This will also ensure that your general knowledge is up-to-date and relevant, since reading about banking terminology requires keeping abreast of current events in finance and economics.

Reasoning Section

The logical reasoning section tests your ability to understand written information and evaluate its credibility. Questions focus on logical connections between ideas and make inferences based on those connections. These questions don’t test actual knowledge of facts; instead, they test your ability to read something and then make deductions based on what you’ve read.

Logical Reasoning Section

Logical reasoning questions ask you to reason from one or more statements of fact. You may be asked how specific pieces of information fit into a broader puzzle or how seemingly unrelated items are related. Some questions will require you to examine statistical data and interpret its meaning. In some cases, you’ll need to work with charts, graphs, and other types of visual information. When using charts, graphs, and other visuals you should pay careful attention to things like scale, context, and labeling. Be aware that it’s not always necessary to work with all available information; choose your approach wisely so that it fits both your strengths and weaknesses as well as those inherent in each question type.

Quantitative Aptitude Section

The quantitative aptitude section is composed of 35 questions. Some of these questions are based on simple arithmetic problems like adding, subtracting, multiplying and dividing whole numbers. Other questions are based on concepts like fractions, percentages, averages and interest. The exam will not include trigonometry or geometry-based problems. Candidates must be able to solve all types of mathematical problems with ease and accuracy as there will be no negative marking scheme in place while evaluating answers. The following topics can be expected

Verbal Ability and Reading Comprehension Section

The CAT exam contains two 30-minute sections. For both sections, you have 60 minutes to read all of the passages and questions. There are three reading comprehension passages with seven questions each, so at least seven of your questions will be based on reading comprehension from texts and charts. This section tests your ability to recognize similarities and differences between groups, as well as your understanding of cause-and-effect relationships. Questions tend to focus on data analysis or synthesis through graphs or tables. You might also see some antonyms or analogies within text.

English Language and Computer Awareness Section

While there are exams that require you to have some sort of special degree, one common question banks always ask you is how well you can use English. This can include anything from writing emails and memos, as well as speaking and comprehension skills. So make sure your English is at its best! The other important section on your exam will be computer awareness. Keep up with IT trends and make sure you know how to use basic software on a computer. For example, many banks accept Microsoft Office Suite (Word, Excel) documents so it’s very important that candidates are familiar with these programs. And yes—practice typing too! It may sound trivial but believe us when we say how relevant it actually is.